Exclusively for Accredited Investors.

Eigen Quant Fund | Advanced AI-Driven Quantitative Trading Platform

A systematic fund leveraging deep learning models and proprietary automation to uncover alpha in FX, crypto, commodities, and indices. Designed for allocators who demand more than market exposure.

Coming soon

Harnessing the Liquidity Pool of Our Institutional Providers

Harnessing the Liquidity Pool

of Our Institutional Providers

Multi-Layered Quant Infrastructure. One Unified Engine.

OUR EDGE

OUR EDGE

OUR EDGE

Built on Data.

Designed for Execution.

A system shaped by global markets and years of testing.

A system shaped by global markets and years of testing.

Built on Evidence, Not Assumptions

Four years of live and simulated performance data and our 3rd party Audits can prove it.

Built on Evidence, Not Assumptions

Four years of live and simulated performance data and our 3rd party Audits can prove it.

Built on Evidence, Not Assumptions

Four years of live and simulated performance data and our 3rd party Audits can prove it.

Adaptive by Nature

Strategies that respond to evolving market dynamics.

Adaptive by Nature

Strategies that respond to evolving market dynamics.

Adaptive by Nature

Strategies that respond to evolving market dynamics.

Timing, Perfected

24/5 market execution with zero friction.

Timing, Perfected

24/5 market execution with zero friction.

Timing, Perfected

24/5 market execution with zero friction.

Global Markets, Singular Focus

Currencies, commodities, and indices without compromise.

Global Markets, Singular Focus

Currencies, commodities, and indices without compromise.

Global Markets, Singular Focus

Currencies, commodities, and indices without compromise.

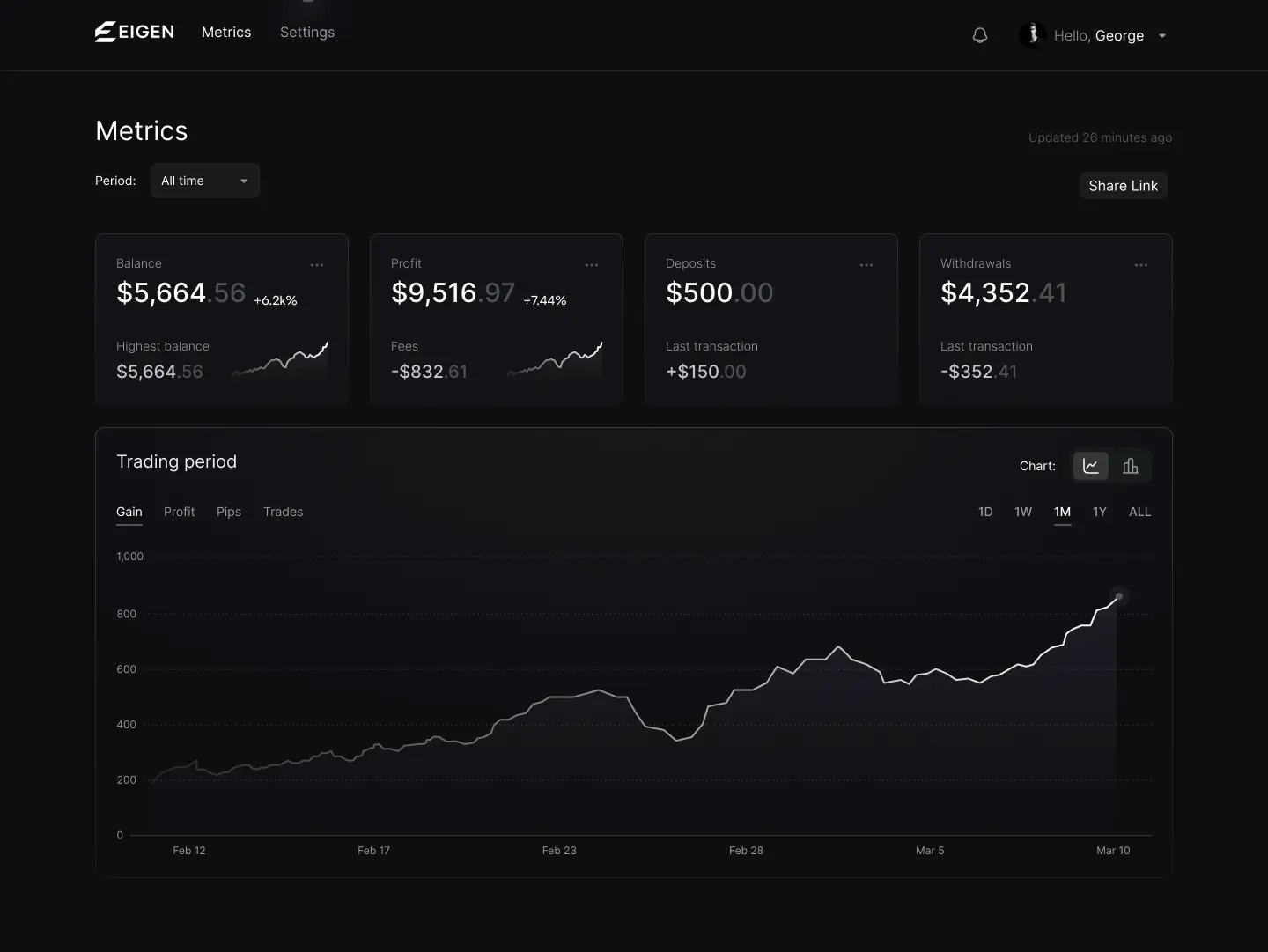

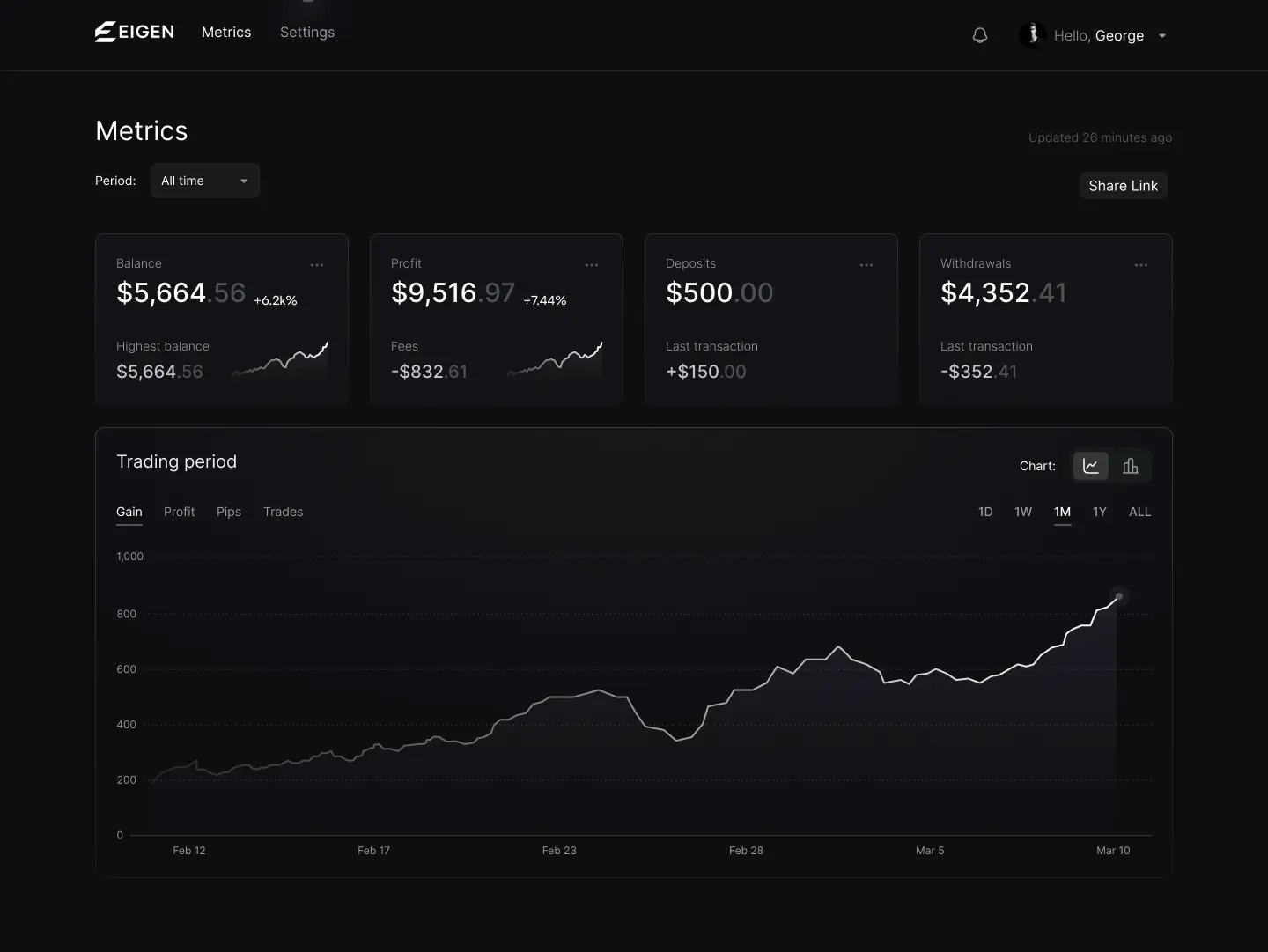

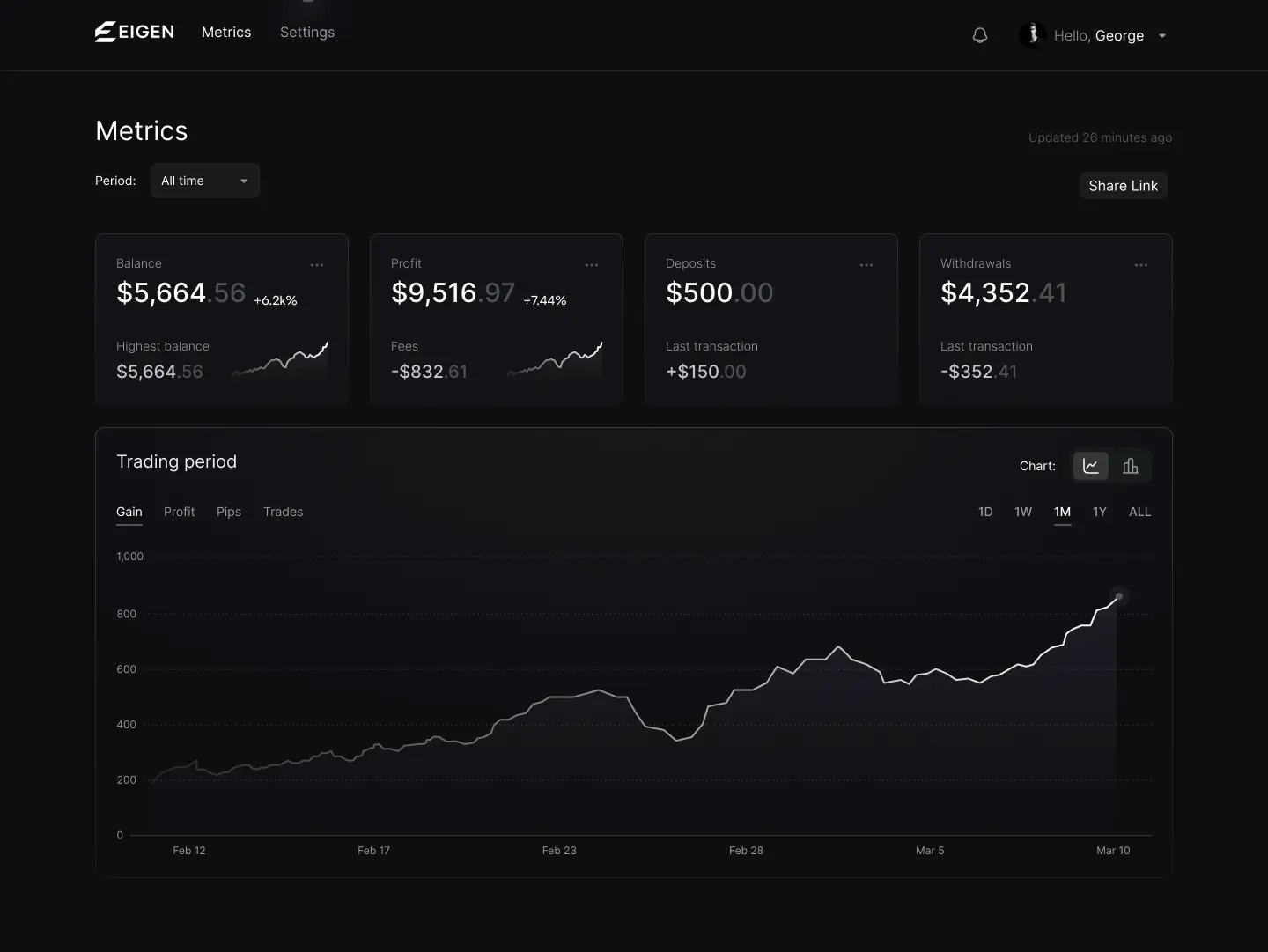

INVESTOR PORTAL

INVESTOR PORTAL

INVESTOR PORTAL

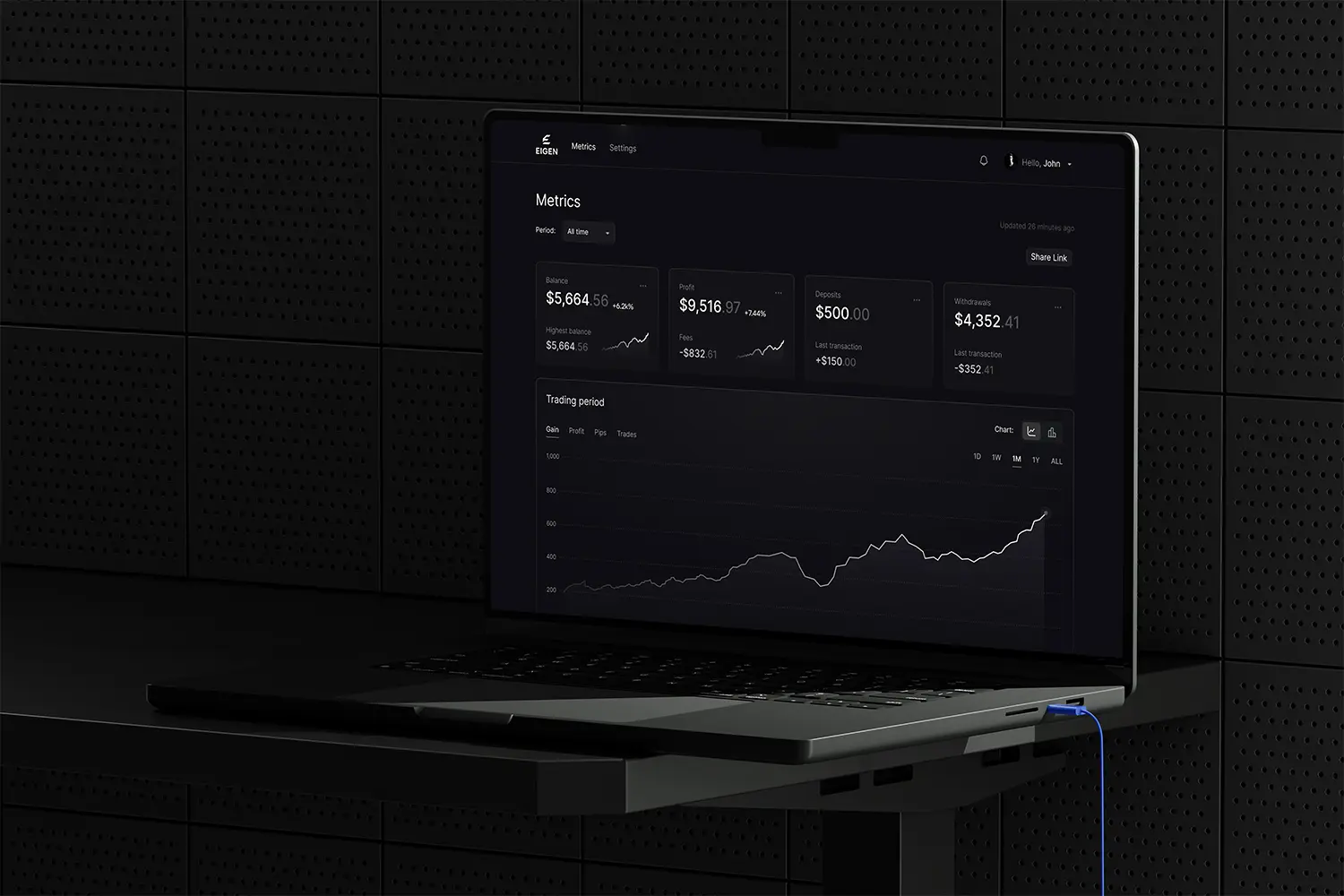

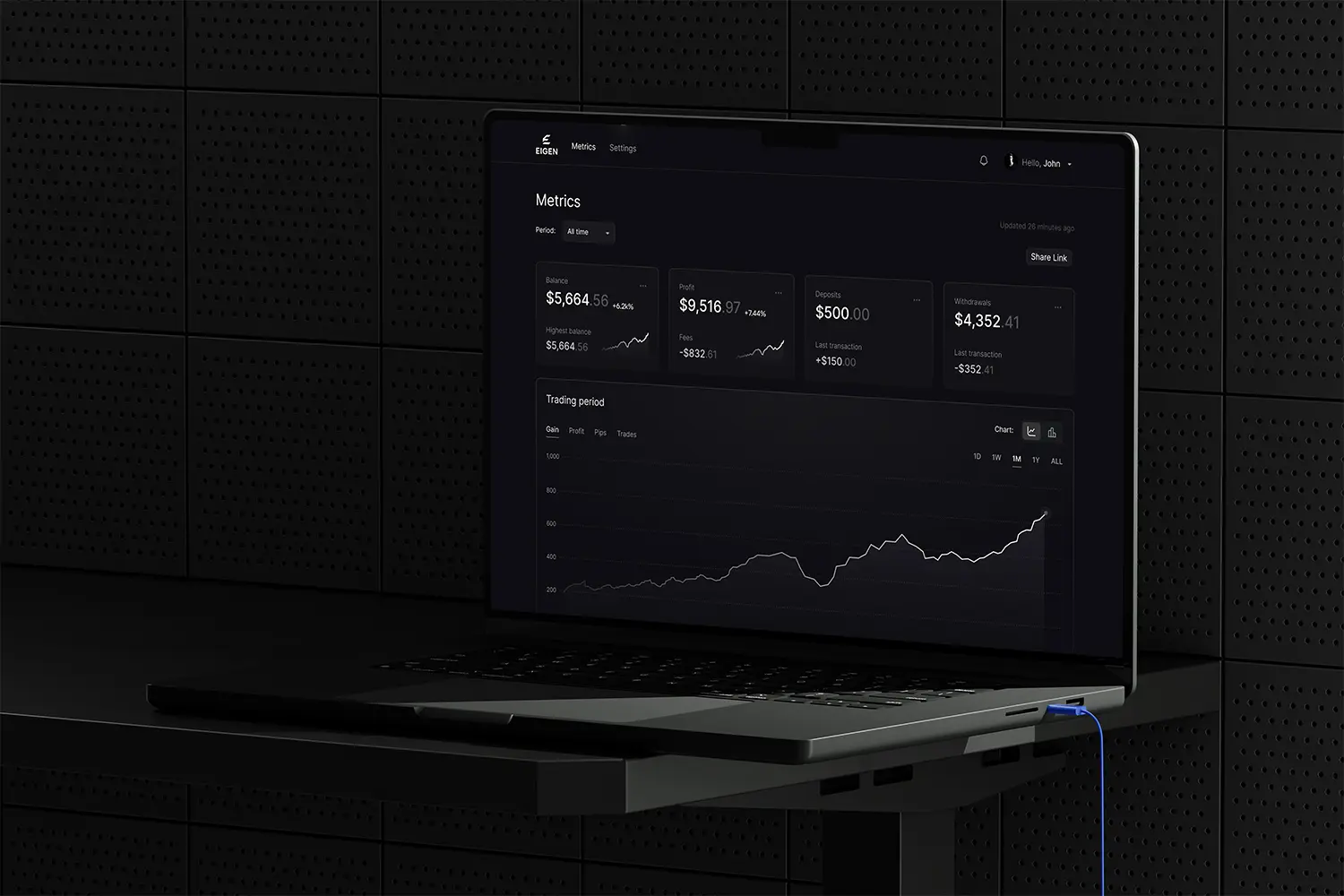

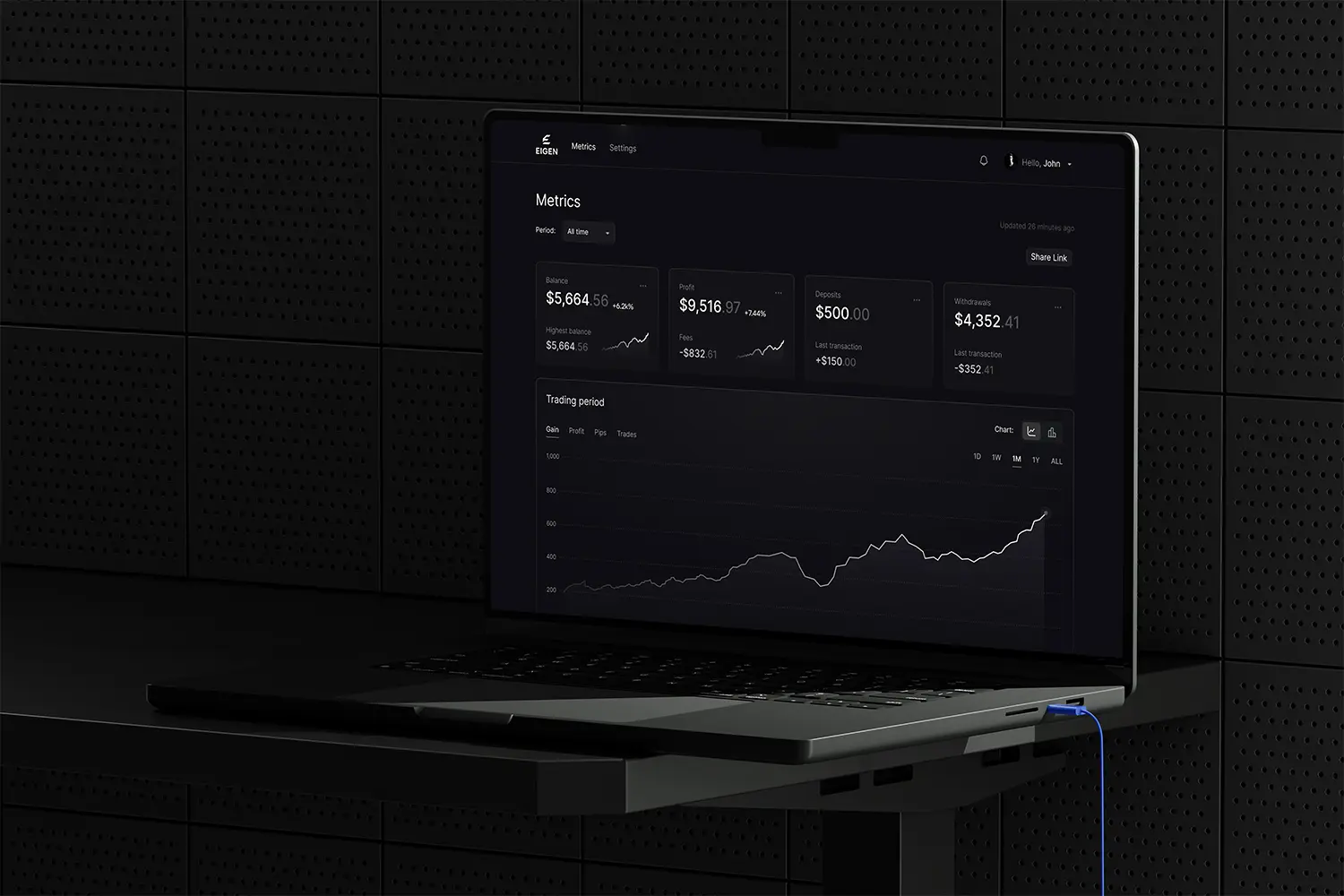

Complete Visibility.

Absolute Control.

A unified dashboard delivering real-time performance, exposure, and strategy insights across desktop and mobile.

A unified dashboard delivering real-time performance, exposure, and strategy insights across desktop and mobile.

Desktop

Mobile

Deep Insight, Full Detail

Access advanced dashboards, multi-strategy breakdowns, and allocation heatmaps in a high-resolution interface built for focus and analysis.

Multi-Strategy Performance Breakdown

Allocation & Exposure Heatmaps

Historical & Real-Time Analytics

Desktop

Mobile

Deep Insight, Full Detail

Access advanced dashboards, multi-strategy breakdowns, and allocation heatmaps in a high-resolution interface built for focus and analysis.

Multi-Strategy Performance Breakdown

Allocation & Exposure Heatmaps

Historical & Real-Time Analytics

Desktop

Mobile

Deep Insight, Full Detail

Access advanced dashboards, multi-strategy breakdowns, and allocation heatmaps in a high-resolution interface built for focus and analysis.

Multi-Strategy Performance Breakdown

Allocation & Exposure Heatmaps

Historical & Real-Time Analytics

Oversight Without

Micromanagement

Stay informed and confident without needing to manage trades or execution.

Oversight Without

Micromanagement

Stay informed and confident without needing to manage trades or execution.

Oversight Without

Micromanagement

Stay informed and confident without needing to manage trades or execution.

Confidence in

Risk Alignment

Understand how capital is deployed and how risk is controlled at all times.

Confidence in

Risk Alignment

Understand how capital is deployed and how risk is controlled at all times.

Confidence in

Risk Alignment

Understand how capital is deployed and how risk is controlled at all times.

Faster, Clearer

Decisions

All relevant information surfaces clearly, without noise or interpretation gaps.

Faster, Clearer

Decisions

All relevant information surfaces clearly, without noise or interpretation gaps.

Faster, Clearer

Decisions

All relevant information surfaces clearly, without noise or interpretation gaps.

Institutional-Grade

Transparency

Designed for reporting, review, and long-term trust - not speculation.

Institutional-Grade

Transparency

Designed for reporting, review, and long-term trust - not speculation.

Institutional-Grade

Transparency

Designed for reporting, review, and long-term trust - not speculation.

ONBOARDING PROCESS

ONBOARDING PROCESS

ONBOARDING PROCESS

Institutional-Grade Infrastructure, Simplified Access

We operate under a 506(c) exempt structure and is available to accredited investors for direct fund participation.

We operate under a 506(c) exempt structure and is available to accredited investors for direct fund participation.

01.

02.

03.

04.

1. Create Your Account

Complete KYC / AML and answer the questionnaire. You will then gain access to the Investor Dashboard.

1. Create Your Account

Complete KYC / AML and answer the questionnaire. You will then gain access to the Investor Dashboard.

1. Create Your Account

Complete KYC / AML and answer the questionnaire. You will then gain access to the Investor Dashboard.

2. Choose Your Winning Strategy

Select the strategy — or blend of strategies — that best supports your objectives and risk profile.

2. Choose Your Winning Strategy

Select the strategy — or blend of strategies — that best supports your objectives and risk profile.

2. Choose Your Winning Strategy

Select the strategy — or blend of strategies — that best supports your objectives and risk profile.

3. Deposit Funds via Investor Portal

We’ll help establish your account with our regulated brokerage partner, where you retain full ownership and control of your capital.

3. Deposit Funds via Investor Portal

We’ll help establish your account with our regulated brokerage partner, where you retain full ownership and control of your capital.

3. Deposit Funds via Investor Portal

We’ll help establish your account with our regulated brokerage partner, where you retain full ownership and control of your capital.

4. Launch, Track, and Scale

Your chosen strategy is deployed on our trading platform. Monitor live performance via your dashboard, adjust positioning, or launch additional models as you grow.

4. Launch, Track, and Scale

Your chosen strategy is deployed on our trading platform. Monitor live performance via your dashboard, adjust positioning, or launch additional models as you grow.

4. Launch, Track, and Scale

Your chosen strategy is deployed on our trading platform. Monitor live performance via your dashboard, adjust positioning, or launch additional models as you grow.

BENEFITS

BENEFITS

BENEFITS

Benefits for Investors

Gain diversified exposure to multiple strategies, unlock selective deals, and receive transparent reporting - aiming for superior, risk-adjusted returns.

Diversified Exposure

Diversified Exposure

Diversified Exposure

Access to Exclusive Opportunities

Access to Exclusive Opportunities

Access to Exclusive Opportunities

Transparency and Reporting

Transparency and Reporting

Transparency and Reporting

Potential for High Returns

Potential for High Returns

Potential for High Returns

Military Grade Security

Military Grade Security

Military Grade Security

FAQ

FAQ

FAQ

Frequently asked questions

Answers to common questions about getting started and investing with Eigen.

Answers to common questions about getting started and investing with Eigen.

What is quantitative investing?

Is this suitable for beginner investors?

Can I see the performance of each strategy?

How do we know the strategies work?

Are the strategies actively managed?

What is quantitative investing?

Is this suitable for beginner investors?

Can I see the performance of each strategy?

How do we know the strategies work?

Are the strategies actively managed?

What is quantitative investing?

Is this suitable for beginner investors?

Can I see the performance of each strategy?

How do we know the strategies work?

Are the strategies actively managed?

How do I register?

How much does Eigen charge?

Can I access my money at any time?

Who handles my capital ?

Who can I contact if I have any questions?

How do I register?

How much does Eigen charge?

Can I access my money at any time?

Who handles my capital ?

Who can I contact if I have any questions?

How do I register?

How much does Eigen charge?

Can I access my money at any time?

Who handles my capital ?

Who can I contact if I have any questions?

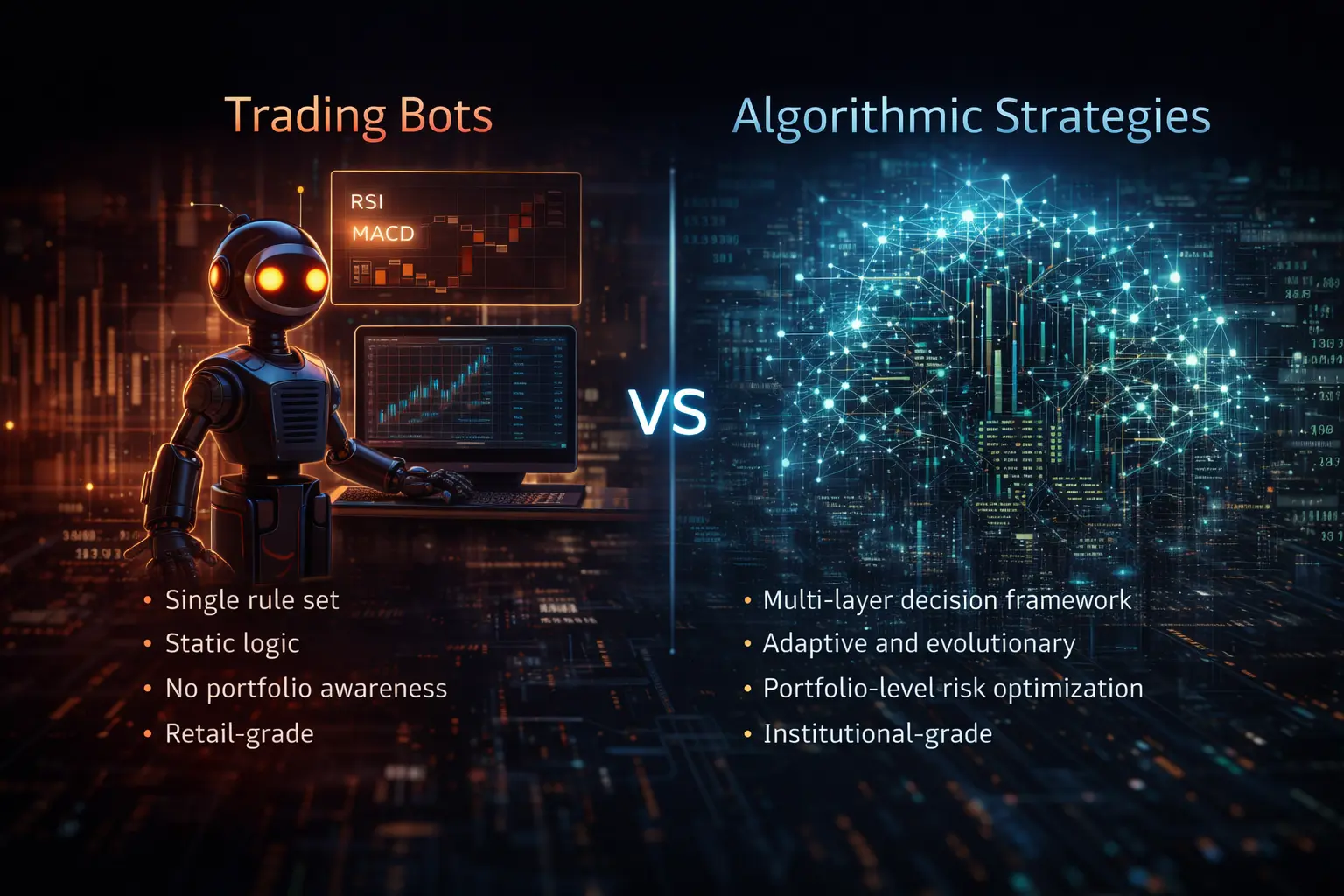

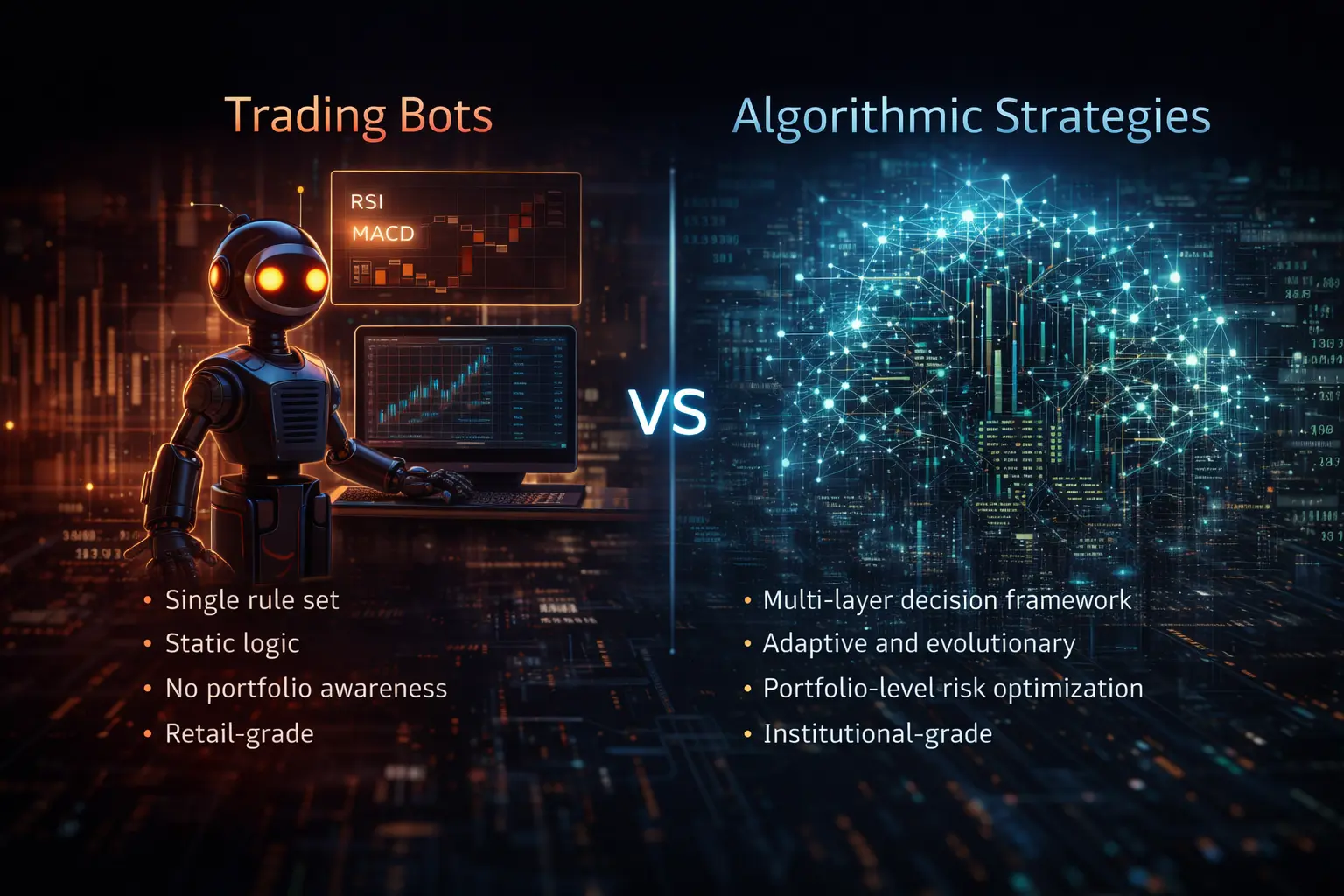

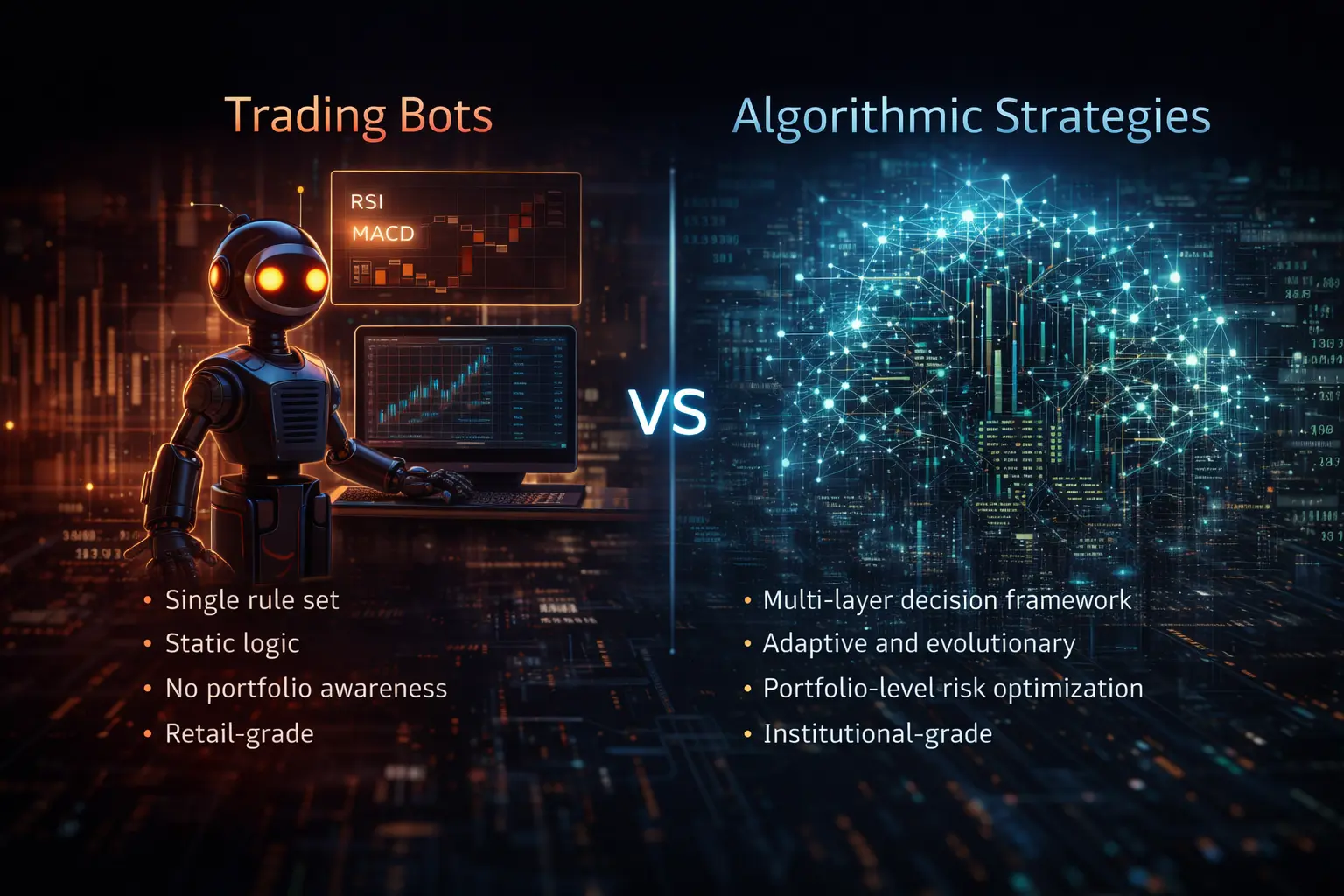

Understanding Eigen Tech

No. Eigen uses algorithmic trading

systems, not bots.

What Is a Trading Bot?

A trading bot is: Single-script or rule-based program. Executes predefined signals (e.g., RSI oversold, MACD crossover). Operates independently per market. Uses static logic. Common in retail platforms and copy-trading systems.

Key Limitations: One strategy per bot. Limited adaptability. Minimal portfolio awareness. Context-blind execution. Rarely optimized at portfolio level.

The Problem: A bot answers: "If X happens, place trade Y." This approach does not scale, adapt, or manage risk holistically.

What Eigen Uses Instead

Key Differences

How Eigen's System Works

The Difference in Practice

How We Describe This

Benefits for Investors

What Is a Trading Bot?

A trading bot is: Single-script or rule-based program. Executes predefined signals (e.g., RSI oversold, MACD crossover). Operates independently per market. Uses static logic. Common in retail platforms and copy-trading systems.

Key Limitations: One strategy per bot. Limited adaptability. Minimal portfolio awareness. Context-blind execution. Rarely optimized at portfolio level.

The Problem: A bot answers: "If X happens, place trade Y." This approach does not scale, adapt, or manage risk holistically.

What Eigen Uses Instead

Key Differences

How Eigen's System Works

The Difference in Practice

How We Describe This

Benefits for Investors

What Is a Trading Bot?

A trading bot is: Single-script or rule-based program. Executes predefined signals (e.g., RSI oversold, MACD crossover). Operates independently per market. Uses static logic. Common in retail platforms and copy-trading systems.

Key Limitations: One strategy per bot. Limited adaptability. Minimal portfolio awareness. Context-blind execution. Rarely optimized at portfolio level.

The Problem: A bot answers: "If X happens, place trade Y." This approach does not scale, adapt, or manage risk holistically.

What Eigen Uses Instead

Key Differences

How Eigen's System Works

The Difference in Practice

How We Describe This

Benefits for Investors